The 2025 real estate market was not a boom year—and it wasn’t a crash either. Instead, it was a year of adjustment.

After several years of dramatic price growth, rising interest rates, and fast-paced competition, the housing market in 2025 slowed down and recalibrated. Buyers became more cautious. Sellers became more strategic. And affordability became the biggest conversation in real estate.

Here’s a clear breakdown of what actually happened in the 2025 housing market—and what it means going forward.

Homeownership Trends in 2025

First-Time Buyers Hit a Record Low

In 2025, first-time buyers made up just 21% of all home purchases, the lowest share ever recorded. (per National Association of Realtors).

High home prices and elevated mortgage rates pushed many younger buyers to pause, rent longer, or rely on family assistance. As a result, the average age of first-time buyers continued to rise, while repeat buyers dominated the market.

Cash Buyers and Equity Buyers Had the Advantage

Buyers who already owned homes—or who could pay cash—had a clear edge in 2025.

Roughly 1 in 4 homes were purchased with cash

Repeat buyers often used equity from previous homes

Larger down payments helped buyers compete without extreme overbidding

This created a growing divide between buyers who wanted to move and buyers who were actually able to move.

Mortgage Rates in 2025: Lower, But Still Limiting

Mortgage rates cooled slightly in 2025 but remained well above pre-pandemic levels.

The average 30-year mortgage rate hovered around 6%–6.5% (per Freddie Mac)

Rates were lower than 2024 highs, but still high enough to impact monthly payments

Many homeowners stayed locked into ultra-low rates from previous years

While lower rates did increase some refinancing activity, they were not low enough to unlock a large wave of new listings.

Home Prices in 2025: Growth Slowed Significantly

After years of rapid appreciation, home price growth slowed sharply in 2025.

- National price growth averaged around 2%

- Some markets saw flat or slightly declining prices

- Fewer bidding wars compared to previous years

This slowdown helped stabilize the market and reduced extreme price pressure—but affordability challenges remained.

Greenville & Upstate South Carolina Real Estate Trends in 2025

While national real estate trends showed a slowing and stabilizing market, Greenville, SC and the Upstate region followed that pattern with a strong local twist.

In 2025, Greenville home values continued to rise—but at a much slower pace than previous years.

Typical home values increased roughly 1%–2% year over year

Median sale prices in Greenville hovered in the low-to-mid $300,000s

Unlike some larger metro areas, Greenville did not experience major price drops. Instead, the market shifted into steady, sustainable growth.

Inventory Increased Across the Upstate

One of the biggest local changes in 2025 was inventory growth.

Active listings increased significantly year over year in Greenville and surrounding Upstate markets

Buyers had more choices and less pressure to waive contingencies

This marked a clear shift away from the ultra-tight inventory of 2021–2023.

Homes Took Longer to Sell—but Still Moved

Days on market increased compared to recent years, but homes still sold within a reasonable timeframe when priced correctly. Days on Market rose to 52 days in 2025, up from 48 days in 2024 and 46 days in 2023

This is a classic sign of a balanced market, not a declining one.

Seller strategy became critical... In Greenville and the Upstate, sellers who:

priced realistically

prepared homes properly

invested in professional marketing

continued to succeed. Overpricing became one of the biggest reasons homes stalled.

Final Words

2025 was not a collapse—it was a reset.

One thing stood out: there was a type of buyer who consistently had the advantage. Equity mattered. Cash mattered. And simply getting your foot in the door made a real difference.

The market shifted from fast and emotional to slower and more thoughtful. Buyers gained leverage. Sellers had to adjust expectations. And strategy mattered more than speed.

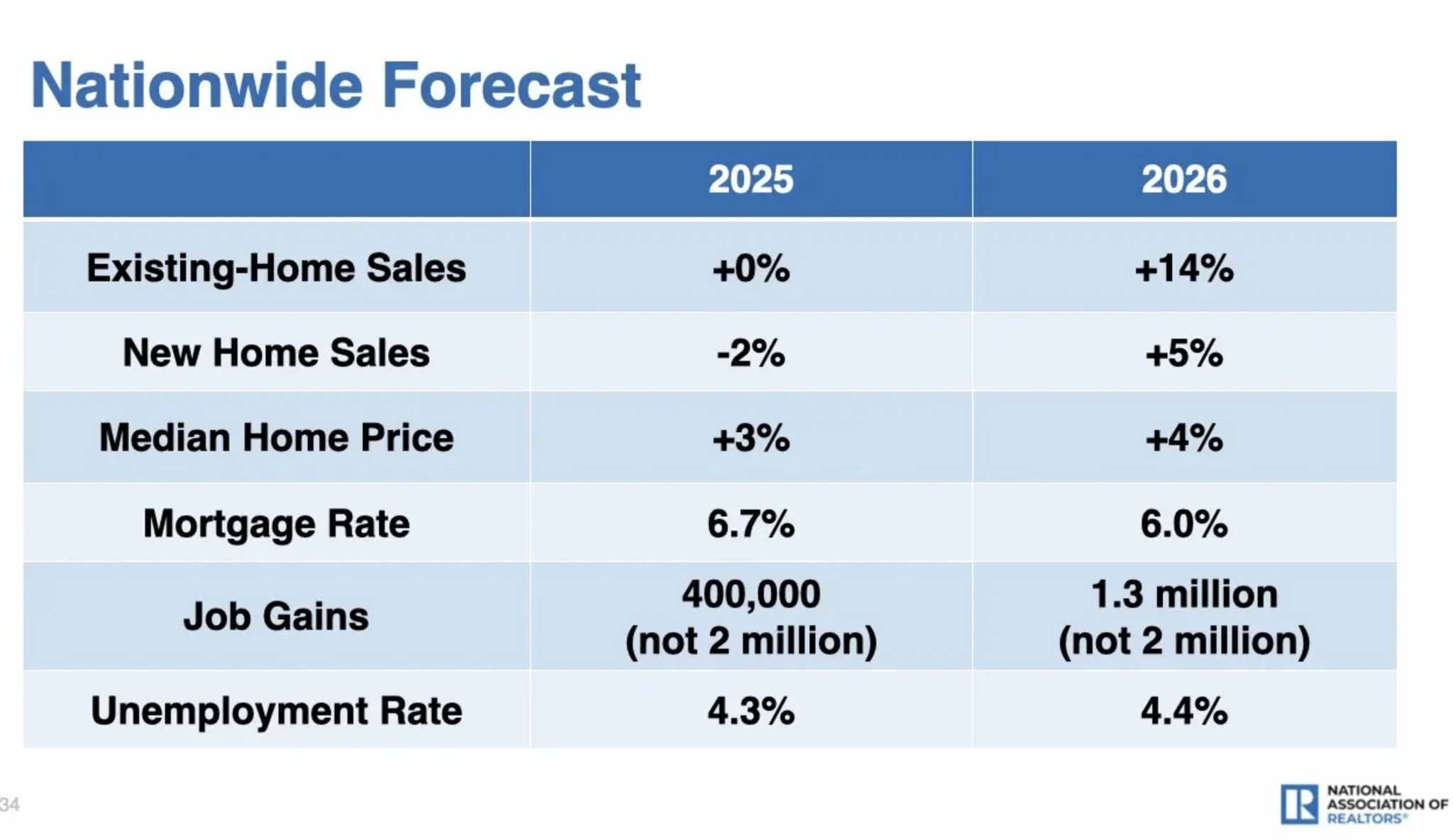

Looking ahead, there are signs of renewed momentum. The National Association of REALTORS® projects a strong rebound in 2026, forecasting roughly a 14% increase in existing-home sales (per source). This outlook is driven by expectations of lower mortgage rates near 6%, increased inventory, and continued job growth, according to Chief Economist Lawrence Yun.

After a period of stagnation, the housing market appears to be moving toward greater balance and stability—setting the stage for a more active, but more grounded, year ahead....