Why Home Ownership Protects You Against Inflation

Inflation is on the rise. According to Market Watch, inflation is at 40-year high and experts don’t expect it to slow down, estimating average cost of living could surge as high as 9%. Such dramatic increases make it impossible not to feel the impact in your daily life as gas, food, and other staples steadily become more expensive. These changes often mean consumers hold off on making larger purchases (like a home) until things calm down.

Today, we’re talking about the impact inflation has on the housing market and why purchasing a home might just be the smart choice in this economic environment.

Homeowners take control of one of their largest monthly expenses

We’ve already talked about inflation’s impact on gas, groceries, and other necessities. Just like these daily staples, home and rent prices also increase with rising inflation. If you are renting, you are doubtless anticipating an increase in your monthly payment soon. When purchase a home with a loan, you lock in your rate (or your monthly payment) for 15-30 years. Home repairs, taxes, and other costs associated with home ownership may continue to rise, but by purchasing a home you have ensured your monthly housing payment stays constant, something you cannot always guarantee with renting.

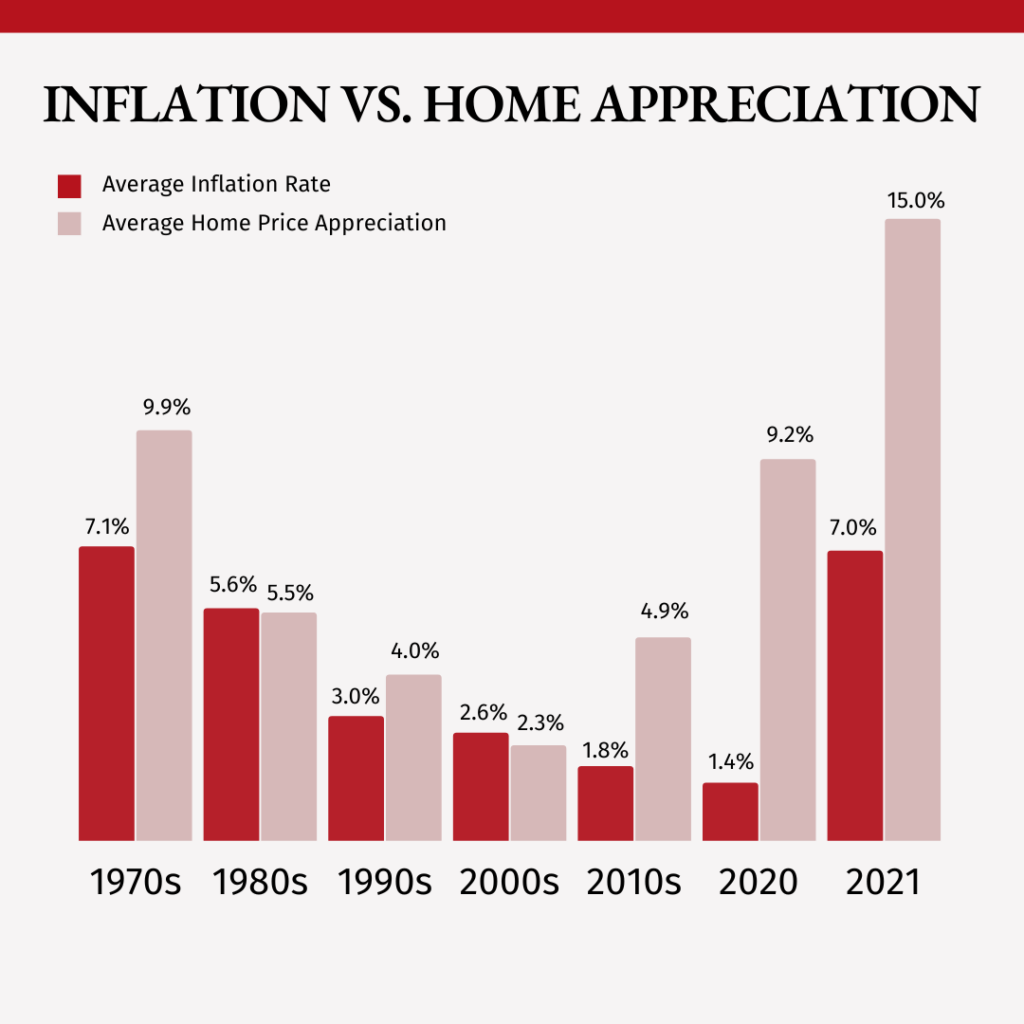

Home appreciation consistently beats out inflation

Sure, rising mortgage rates mean you cannot afford the same home you could a few months ago, but investing in real estate is still a smart decision. For years, home appreciation has consistently outperformed inflation, meaning your home will continue to hold or gain value, even in inflationary times. Consider the following graph:

Dan Hamilton is the founder of Hamilton & Co. and the lead listing agent for the team. He is the only agent in the Upstate endorsed by Shark Tank star and real estate mogul Barbara Corcoran. Additionally, Dan hosts a weekly radio show on The Answer 94.5 and 106.3 WORD giving tips and advice on real estate and is a frequent contributor for real estate on Your Carolina TV show on WSPA Channel 7.

Making Greenville Home

At Hamilton & Co. we bring years of experience to the table, paired with our passion for excellence and committed customer service.

VISIT

403 Woods Lake Rd #100, Greenville, SC 29607

All Rights Reserved | Hamilton & Company | Privacy Policy | Sitemap

Real Estate Web Design by Bullsai